High Debt Levels

Debt is one of the most significant financial challenges many people face. Particularly, high-interest loans can be a huge obstacle to building wealth. High debt levels can drain your resources, limit your ability to save and invest, and keep you stuck in a cycle of repayments. If you’re looking to eliminate debt and build your financial freedom, it’s time to take action. Here’s how you can manage high debt levels effectively and set yourself on the path to financial success.

How Debt Holds You Back

Debt affects more than just your wallet. Here are several ways it can hinder your financial growth:

- Limits Disposable Income: A large portion of your income goes toward repaying loans and interest. This leaves less money available for saving or investing.

- Prevents Wealth Building: High debt levels consume your ability to invest in wealth-building strategies like stocks, real estate, or retirement funds.

- Increases Financial Stress: Managing multiple debts and meeting different repayment deadlines can be overwhelming, leading to increased stress.

- Restricts Opportunities: With high debt levels, opportunities like starting a business, pursuing further education, or taking financial risks become limited.

How to Overcome This Challenge

Addressing high debt levels requires strategic, disciplined action. By adopting the right approach, you can reduce your debt and start building wealth. Here are three proven strategies:

1. Pay Off Debt Strategically

To pay off debt quickly, you need a strategic approach. Two of the most effective methods for reducing debt include the avalanche method and the snowball method.

- Avalanche Method (Paying Off Debt Quickly): This strategy focuses on paying off the debt with the highest interest rate first. By tackling the most expensive debts first, you minimize the amount of interest you’ll pay in the long run. Once the high-interest debt is cleared, you move on to the next highest interest rate. This method is perfect for those focused on maximizing savings in the long term.

- Snowball Method (Psychological Motivation): This method is for those who prefer small wins to stay motivated. It involves paying off the smallest debt first. Once that debt is cleared, you use the money you were putting toward that debt to pay off the next smallest debt. As you eliminate debts, you build momentum, making it easier to stay on track.

Both methods are effective, so choose the one that fits your personality and financial goals. The important thing is to be consistent.

2. Avoid New Debt

One of the best ways to reduce your financial stress is to stop accumulating new debt. By adopting a cash-first mentality, you can break free from the cycle of borrowing.

- Use Cash or Debit Cards: Avoid using credit cards for everyday purchases. Instead, opt for cash or debit to control spending and keep yourself out of debt.

- Plan Purchases: Before buying something, take time to reflect on whether it’s truly necessary. Use the 24-hour rule for impulse purchases to avoid regret.

- Build an Emergency Fund: One of the main reasons people fall into debt is due to unexpected expenses. An emergency fund can provide a financial cushion and prevent you from relying on credit cards or loans during emergencies.

By making smarter financial choices and living within your means, you’ll avoid the burden of accumulating new debt.

3. Consolidate Loans

Debt consolidation is an effective strategy for managing multiple debts and reducing the amount of interest you pay. Consolidation involves combining several debts into a single loan with a lower interest rate. Here’s how to consolidate loans and the benefits of doing so:

- What Is Debt Consolidation? Debt consolidation is the process of taking out a new loan to pay off existing high-interest debts, such as credit card balances or payday loans. This new loan typically comes with a lower interest rate, which can reduce the amount you pay in interest over time.

- Benefits of Consolidation:

- Lower interest rates mean more of your payment goes toward reducing the principal balance rather than paying interest.

- Simplified payments, as you only need to manage one loan and one payment each month.

- Potentially faster repayment if you choose a loan term that allows you to pay off your debt more quickly.

How to Consolidate Loans:

When considering consolidation, research options thoroughly. Look for reputable lenders who offer competitive rates. Before committing to a consolidation loan, make sure you understand the terms and ensure it will result in real savings.

Caution: Debt consolidation can only help if you don’t fall back into the trap of accumulating new debt. Make sure to stick to your repayment plan and avoid taking on additional credit.

Additional Tips to Manage and Reduce Debt

Here are some extra tips to help you take charge of your debt:

- Negotiate with Creditors: Contact your creditors and see if they can offer you a lower interest rate or a more manageable repayment plan.

- Track Your Progress: Use tools like spreadsheets or apps to track your debt repayment progress. Monitoring your success can motivate you to keep going.

- Seek Professional Help: If your debt feels overwhelming, consider consulting a financial advisor or a credit counseling agency. These professionals can guide you on how to consolidate loans and create a debt management plan.

The Long-Term Benefits of Tackling Debt

Eliminating high debt levels offers numerous long-term benefits, both financially and personally:

- Improved Financial Health: With fewer debts to manage, you’ll have more disposable income for savings, investing, and future goals.

- Reduced Stress: Paying off debt alleviates financial anxiety, leading to improved mental health and overall well-being.

- Freedom to Pursue Goals: Once you’re out of debt, you’ll have the freedom to pursue opportunities such as starting a business, buying a home, or traveling.

- Stronger Credit Score: As you reduce debt and make timely payments, your credit score will improve. This opens doors to better financing options, including lower interest rates on loans and credit cards.

A Real-Life Example of Debt Freedom

One of my colleague Sarah, a young professional who struggled with $30,000 in credit card and student loan debt. After years of minimum payments, she decided to take control:

- She started with the avalanche method, focusing on her credit card debt with a 20% interest rate.

- Sarah adopted a cash-only lifestyle, cutting down on discretionary spending and redirecting the savings toward her debt.

- She also consolidated her student loans to secure a lower interest rate and simplify payments.

In just three years, Sarah paid off all her debt. Today, she’s debt-free and building wealth through investments and savings.

Take Action Today

If high debt levels are holding you back, it’s time to take action. Implement strategies like paying off debt quickly, consolidating loans, and avoiding new debt to regain control of your finances. The journey to debt freedom starts with small steps, but the rewards are life-changing.

By following these actionable steps, you can break free from debt and start building the life you’ve always dreamed of. Your future starts today!

Financial Literacy: What It Is, and Why It Is So Important to Teach Teens

Financial literacy refers to the knowledge and skills needed to make informed and effective decisions regarding financial resources.

It encompasses understanding budgeting, saving, investing, managing debt, and navigating the financial tools and systems we use daily.

Teaching financial literacy to teenagers is crucial, as it sets the foundation for their financial well-being and independence.

Here’s why financial literacy is vital and how it can benefit teens:

- EARN.

- SPEND.

- SAVE & INVEST.

- BORROW.

- PROTECT.

What is Financial Literacy?

Financial literacy is the ability to understand and effectively use financial concepts, such as:

- Budgeting: Planning income and expenses to avoid overspending.

- Saving: Setting aside money for future needs and emergencies.

- Investing: Growing wealth by allocating money to assets like stocks, bonds, or mutual funds.

- Debt Management: Understanding loans, credit cards, and interest rates to avoid financial pitfalls.

- Financial Decision-Making: Making informed choices about purchases, contracts, and other monetary commitments.

Why is Teaching Financial Literacy to Teens Important?

Foundation for Financial Independence

As teens transition into adulthood, they’ll face financial responsibilities like managing bank accounts, paying for education, and understanding taxes. Financial literacy equips them with the tools to handle these challenges confidently.Prevention of Financial Mistakes

Poor financial decisions, such as overspending on credit cards or falling into unnecessary debt, can lead to long-term consequences. Teaching teens financial basics helps them avoid these traps.Developing Healthy Money Habits

Early education encourages habits like saving regularly, budgeting wisely, and prioritizing spending. These habits, when formed during teenage years, often persist into adulthood.Understanding the Power of Compound Interest

Teens who grasp the concept of compound interest can begin investing or saving early, maximizing the growth of their money over time.Reducing Financial Stress

Financial illiteracy can lead to anxiety about money. Educating teens about finances gives them confidence and reduces stress associated with managing their resources.Preparing for the Digital Economy

With the rise of digital payment systems, cryptocurrencies, and online banking, understanding how these platforms work is crucial for navigating the modern financial landscape.

How to Teach Financial Literacy to Teens

Start with Basics

Teach fundamental concepts like budgeting, saving, and the importance of distinguishing between needs and wants.Use Real-Life Scenarios

Encourage teens to manage a small budget for school supplies or monthly allowances to practice real-world financial skills.Introduce Banking and Credit

Explain how to open a bank account, the importance of credit scores, and the responsible use of credit cards.Promote Goal Setting

Help teens set short-term and long-term financial goals, such as saving for a gadget or college expenses.Teach About Investing

Simplify the basics of investing, like stocks, bonds, and mutual funds, and discuss the benefits of starting early.Incorporate Technology

Use apps and tools designed for budgeting and saving to make learning interactive and engaging.

Teaching financial literacy to teens is a critical step in ensuring they grow into financially responsible adults. By equipping them with the right knowledge and skills, we empower them to make sound financial decisions, avoid unnecessary debt, and build wealth over time. The sooner they start learning, the better prepared they will be to face the financial challenges of adulthood.

Investing in financial education today creates a generation of confident, informed, and financially secure individuals tomorrow.

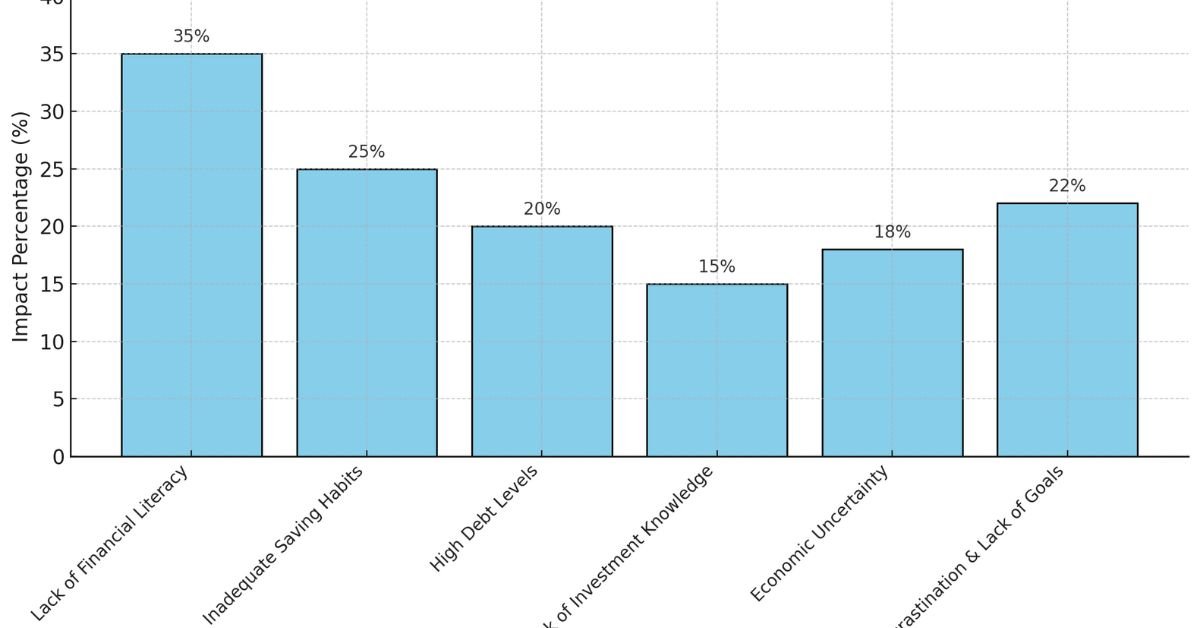

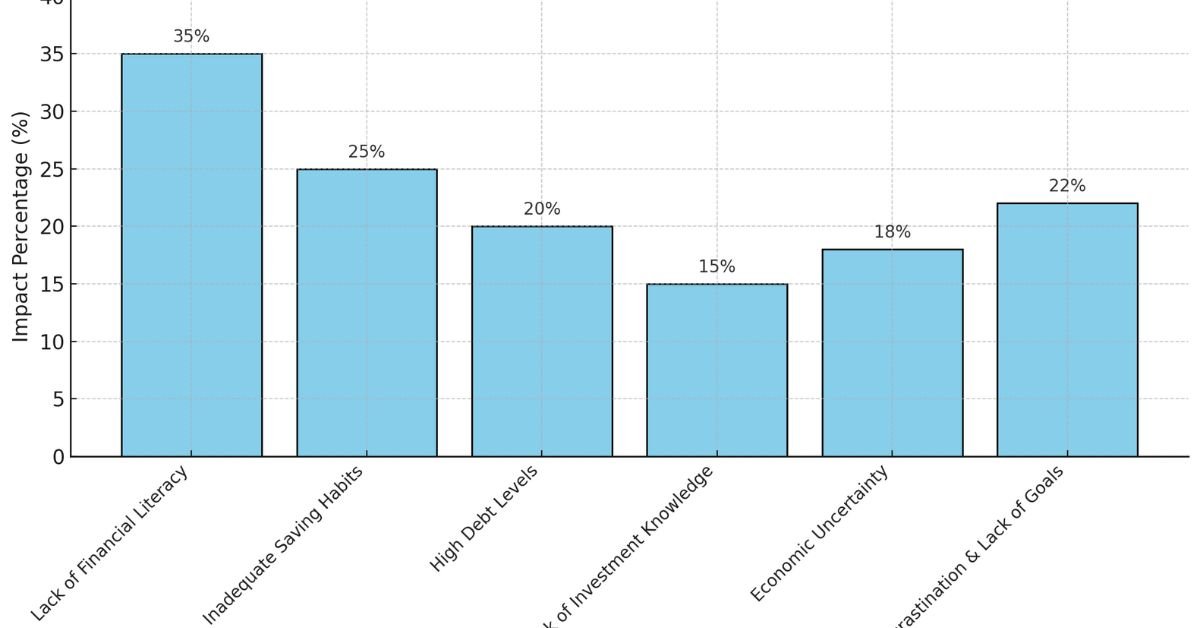

Money Habits Keeping You Poor

Are you struggling to build wealth despite your efforts? The answer might lie in some common money habits that keep people stuck in financial hardship. Recognizing these habits and making small changes can transform your financial future. Here are the key habits to avoid and how to fix them.

1. Poor Spending Habits

Living Beyond Your Means

Overspending on non-essential items or living on credit is a surefire way to remain financially strained.

Solution:

- Track your income and expenses using a budget.

- Avoid unnecessary debt by prioritizing needs over wants.

Impulse Purchases

Buying on a whim drains your finances faster than you realize. Emotional purchases and reacting to sales are common culprits.

Solution:

- Practice mindful spending with a 24-hour rule before making unplanned purchases.

- Stick to a shopping list to avoid distractions.

2. Lack of Financial Planning

Ignoring a Budget

Without a budget, it’s hard to control spending or allocate funds effectively.

Solution:

- Use apps like Mint or YNAB to create a personalized budget.

- Regularly review and adjust your budget to match your financial goals.

Neglecting Financial Goals

Not setting clear financial objectives leads to aimless spending and missed opportunities.

Solution:

- Set SMART goals (specific, measurable, achievable, relevant, time-bound).

- Break long-term goals into smaller, actionable steps.

3. Poor Saving Habits

Failing to Save Consistently

Living paycheck to paycheck without saving makes you vulnerable to financial shocks.

Solution:

- Automate your savings to ensure regular contributions.

- Build an emergency fund to cover 3–6 months of living expenses.

Not Planning for Retirement

Delaying retirement savings reduces your ability to take advantage of compound interest.

Solution:

- Contribute to retirement accounts like 401(k) or IRA.

- Start early to maximize your investment growth.

4. Mismanagement of Debt

Accumulating High-Interest Debt

Credit card debt and payday loans can snowball, eating away at your income.

Solution:

- Prioritize paying off high-interest debts first (debt avalanche method).

- Avoid taking on new debt unless absolutely necessary.

5. Financial Procrastination

Delaying Important Decisions

Procrastinating tasks like paying bills, investing, or creating a will can lead to financial loss.

Solution:

- Break tasks into manageable steps and set deadlines.

- Use reminders or apps to stay on top of financial responsibilities.

6. Lack of Financial Knowledge

Ignoring Financial Education

Without understanding financial concepts, you’re prone to mistakes like overspending or investing in the wrong products.

Solution:

- Read books, take online courses, or follow reputable financial blogs.

- Stay informed about personal finance trends and tools.

Breaking free from bad money habits requires awareness and consistent effort. By addressing poor spending habits, prioritizing savings, and educating yourself on financial matters, you can move toward financial stability and success. Small steps today can lead to significant wealth tomorrow.

Investing Is Complex: Financial Illiteracy or Lack of Trust?

Investing can seem daunting, and for many individuals, it feels complex and overwhelming.

The reasons behind this are multifaceted, with financial illiteracy and lack of trust being two of the most significant contributors.

Understanding how these factors influence people’s perceptions of investing is key to identifying ways to make investing more accessible and less intimidating.

Investing may seem complex, but the truth is, it becomes far simpler with the right education, tools, and mindset.

By tackling the challenges of financial illiteracy and lack of trust, and addressing the common misconception that savings alone will lead to wealth, we can make investing more accessible to everyone.

Start small, diversify, and educate yourself—these are key steps in overcoming the barriers to investing.

Whether you’re new to investing or looking to refine your strategy, taking the first step is crucial in securing a better financial future.

Lack of Investment Knowledge

Many individuals avoid investing simply because they lack investment knowledge. .

Often, the idea of investing seems complex, and parking money in savings accounts or low-interest-bearing accounts feels like a safer option.

However, this is typically the worst mistake one can make if long-term wealth accumulation is the goal.

Why Parking Your Money in the Bank Is a Mistake:

- Inflation Erosion: The purchasing power of savings decreases over time due to inflation. While a savings account may provide security, it doesn’t generate enough returns to outpace inflation, meaning the money you save will be worth less in the future.

- Missed Growth Opportunities: Savings alone won’t create wealth. Investments, on the other hand, provide the opportunity to earn returns through capital appreciation and interest. By avoiding investing, individuals miss out on these potential gains.

How to Overcome This Challenge:

- Start Small: The fear of investment complexity can be alleviated by starting with low-risk, simple investment vehicles like index funds or ETFs (Exchange-Traded Funds). These options offer exposure to a broad range of assets, making them less risky for beginners.

- Diversify Your Portfolio: Spreading your investments across various asset classes, such as stocks, bonds, and alternative assets (real estate, commodities), helps to minimize risk and increase the likelihood of steady returns.

- Educate Yourself: The more you learn about different investment vehicles (stocks, mutual funds, bonds, etc.), the more confident you will become in making decisions. Resources like online courses, books, and financial blogs can provide valuable insights into the risks and returns of different types of investments.

Lack of Trust: Fear of Fraud and Market Volatility

Another major factor that makes investing seem complex is lack of trust in the financial system.

Many individuals fear being taken advantage of or losing money due to market fluctuations, past financial crises, or negative experiences with financial institutions.

Impact of Lack of Trust:

- Fear of Scams or Fraud: With the rise of online investment platforms, some individuals are concerned about being scammed or falling victim to fraudulent schemes.

- Market Volatility: The unpredictable nature of financial markets, especially during times of economic crisis, causes many to distrust the market’s ability to provide consistent returns.

- Distrust in Financial Institutions: Some people feel that financial institutions, advisors, or brokers don’t have their best interests at heart, making them hesitant to seek professional help.

How to Overcome Lack of Trust:

- Transparency: Financial institutions must provide clear, transparent information regarding investment risks, potential rewards, and fees.

- Education on Risk Management: Understanding the role of risk management in investing can help mitigate the fear of market volatility.

- Building Trustworthy Relationships: Working with trusted financial advisors or using well-regulated platforms can help rebuild trust in the investment process.

How Financial Illiteracy and Lack of Trust Work Together

The issues of financial illiteracy and lack of trust are not independent—they often work hand-in-hand. .

Financial illiteracy can breed distrust, especially when individuals are unfamiliar with how investments work or the tools available to them.

Conversely, a lack of trust in the system can prevent individuals from seeking the education they need to make informed investment decisions.

By addressing both of these challenges, we can help individuals feel more confident in their ability to engage with the investment world.

Whether it’s improving financial literacy or rebuilding trust in financial institutions, taking proactive steps can empower people to overcome their fears and misconceptions about investing.

Economic and Employment Uncertainty – How to Overcome Financial Instability

Economic and employment uncertainty is one of the most pressing challenges to building long-term wealth.

From job losses and income fluctuations to broader market instability, these factors can create significant barriers to financial success.

Global events, such as recessions, technological disruptions, or health crises, can exacerbate these challenges, leaving individuals feeling financially vulnerable.

But despite these uncertainties, there are actionable strategies that can help you navigate turbulent times and continue your journey toward financial security.

In this article, we will explore how economic and employment uncertainty affects wealth-building and provide practical tips to overcome these challenges.

How Economic and Employment Uncertainty Affects Your Wealth-Building Efforts

1. Job Loss and Income Instability

Job loss or income instability is perhaps the most immediate financial concern during periods of economic uncertainty.

Economic downturns often lead to layoffs, job cuts, or reduced working hours. Even if you manage to keep your job, income reduction can hinder your ability to save, invest, and build wealth.

Without a steady income, people are forced to dip into savings or take on debt to cover living expenses.

This financial strain can derail long-term wealth-building goals, leaving individuals in a cycle of financial instability.

2. Job Market Volatility and Automation Risks

The job market is constantly changing, and some industries are more vulnerable to volatility than others.

Recessions, market shifts, and technological advancements can cause rapid layoffs, particularly in sectors like manufacturing, technology, and retail.

Moreover, automation and artificial intelligence (AI) are transforming the job landscape, leading to fears about job security.

As automation increases, many traditional jobs are being replaced, causing uncertainty about career prospects and income stability.

3. Unforeseen Expenses

Economic instability often leads to unforeseen expenses, such as medical emergencies, car repairs, or unexpected home repairs.

These costs can further stretch your budget, forcing you to take on debt or delay wealth-building plans.

When faced with unexpected financial strains, individuals often find themselves using credit cards, loans, or liquidating investments, which negatively impacts their ability to save and grow wealth over time.

4. Hesitation to Take Risks

Uncertainty can create fear and hesitation, making people reluctant to take financial risks.

For example, some individuals avoid investing in stocks, real estate, or other wealth-building opportunities because of the perceived risks.

However, avoiding investments due to fear often means missing out on opportunities for growth, especially when markets rebound after a downturn.

How to Overcome Economic and Employment Uncertainty: Practical Strategies for Wealth-Building

While economic uncertainty and employment instability are unavoidable, there are several proactive steps you can take to protect and grow your wealth, regardless of external circumstances.

Here are some of the best strategies for managing financial challenges:

1. Diversify Your Income Streams

Diversifying your income is a critical step in protecting yourself from job loss or economic downturns.

Relying on a single income stream is risky, as it leaves you vulnerable in the event of job loss or income fluctuations.

By exploring multiple sources of income, you can ensure that you remain financially stable even during times of uncertainty.

Side Hustles: Consider starting a side business or freelance work. Whether it’s freelance writing, consulting, or selling products online, additional income streams can supplement your primary job and provide financial security.

Passive Income: Invest in passive income streams such as dividend-paying stocks, rental properties, or digital products that generate revenue without requiring constant effort. This can help stabilize your finances and allow you to continue building wealth even if your job situation changes.

2. Build a Financial Safety Net: The Importance of an Emergency Fund

One of the most important financial strategies during uncertain times is to build an emergency fund.

An emergency fund serves as a financial buffer, giving you the peace of mind to weather job loss, income cuts, or other unforeseen events without draining your investments or going into debt.

A well-funded emergency fund should cover three to six months of living expenses. Keep it in a liquid, low-risk account, such as a high-yield savings account or a money market account.

This ensures that you have quick access to funds when needed, without having to liquidate long-term investments.

3. Upskill and Adapt to Market Changes

Upskilling is essential to staying competitive in an ever-changing job market. During periods of economic uncertainty, it’s crucial to invest in learning new skills that will make you more marketable and adaptable to the evolving job landscape.

This is especially important in industries affected by automation and technological disruption.

Invest in Professional Development: Consider taking courses, certifications, or training in fields that are in demand, such as data analysis, IT, digital marketing, or healthcare. These industries are less likely to be replaced by automation and offer more job security.

Develop Soft Skills: In addition to technical skills, strong soft skills—such as communication, leadership, and problem-solving—are highly valued across industries and can give you an edge in the job market.

4. Live Below Your Means and Control Spending

Living below your means is one of the most effective ways to build financial resilience during uncertain times. By controlling your spending, you can ensure that you have more money available to save and invest, even if your income fluctuates.

Create a Budget: Start by creating a budget that tracks your income and expenses. This will help you identify areas where you can cut back on discretionary spending and redirect those savings toward an emergency fund or investment portfolio.

Cut Unnecessary Expenses: Avoid lifestyle inflation, especially during periods of economic uncertainty. Focus on minimizing luxury expenses and prioritize saving for long-term financial goals.

Thriving During Economic and Employment Uncertainty

Economic and employment uncertainty is an unavoidable part of the financial landscape, but it doesn’t have to stop you from achieving your wealth-building goals.

By taking proactive steps such as diversifying your income, building an emergency fund, upskilling, and controlling your spending, you can safeguard your financial future and continue to grow your wealth despite economic volatility.

While you may not be able to control market fluctuations or job market instability, you can control how you prepare for and respond to these challenges.

With a strategic approach, financial discipline, and a long-term perspective, you can not only weather the storm of economic uncertainty but also capitalize on opportunities that arise from it.

Start taking these steps today to secure your financial future and protect your wealth from economic and employment uncertainty.

Key Takeaways to Overcome Financial Challenges and Build Wealth

Improve Financial Literacy: Invest in learning about budgeting, saving, and investing. Use online courses, books, and expert resources to enhance your financial knowledge.

Cultivate Financial Discipline: Stick to a budget, track your expenses, and make regular savings and investment contributions. Consistency is key to achieving long-term wealth.

Tackle High Debt: Prioritize paying off high-interest debts first using the avalanche or snowball method. Avoid new debt and consider loan consolidation to lower interest rates.

Invest for the Future: Begin with simple investments like index funds or ETFs, then gradually diversify your portfolio to manage risk. Educate yourself on different investment strategies and asset classes.

Prepare for Economic and Employment Uncertainty: Diversify your income streams to reduce reliance on a single job. Build an emergency fund covering three to six months of living expenses. Focus on long-term financial goals and resist panic during market fluctuations.

Combat Inflation: Invest in assets that typically outperform inflation, such as stocks, real estate, and bonds. Keep expenses in check and prioritize long-term financial growth.

Overcome Fear of Risk: Learn about investment risks and start with a diversified portfolio that balances risk and return. Gradually increase your exposure to risk as you become more comfortable with investment strategies.

By addressing these challenges with actionable strategies, you can enhance your financial literacy, improve your wealth-building habits, and protect yourself against economic uncertainties. Focus on education, diversification, and disciplined financial planning to achieve long-term financial success.

Hasnain Aslam is a seasoned finance blogger and digital marketing strategist with a strong expertise in SEO, content marketing, and business growth strategies. With years of experience helping entrepreneurs and businesses boost their online presence and maximize organic traffic, he specializes in crafting high-impact content that ranks on search engines and drives real results. His insights empower professionals to build sustainable digital success through strategic marketing and innovative SEO techniques.