Ready to Escape 9-to-5? Best Income Strategies!

Creating multiple streams of income is a proven strategy to achieve financial freedom.

Relying on a single income source can be risky, especially in uncertain economic times.

Building multiple streams of income is a powerful strategy for achieving financial freedom.

Start by identifying your skills and interests to create side hustles like freelancing or consulting. Consider investing in assets such as stocks, real estate, or peer-to-peer lending platforms.

Build a passive income source with digital products, like e-books or online courses.

Affiliate marketing can generate income through promoting products or services you love.

Monetize your hobbies, such as blogging or YouTube channels. Utilize automation tools to reduce your active involvement in your income streams. Be consistent and reinvest your earnings to grow your wealth over time.

Diversify income sources to protect against market volatility. Set clear financial goals and track your progress regularly.

By strategically building multiple streams of income, you can secure your path to financial freedom.

The Importance of Multiple Income Streams

Multiple income streams are essential for financial security and wealth building.

Relying on one source of income can be risky, especially in uncertain times. By diversifying your income, you reduce the impact of job loss or market downturns.

Multiple streams, such as investments, side businesses, and passive income, provide financial stability.

Building these income sources takes time and effort, but the long-term benefits are significant. You can generate more money by leveraging your skills, resources, and network.

These streams also allow you to reinvest and grow your wealth faster. Financial freedom becomes more attainable as you increase your income.

Whether through real estate, stocks, or digital products, each stream adds a layer of financial security. Start today to diversify and secure a stronger financial future.

Relying solely on one income stream—typically from a single job—leaves individuals vulnerable to financial instability.

By diversifying income sources, you mitigate risks, increase your earning potential, and gain more flexibility in managing finances.

| Benefit | Description | Example |

|---|---|---|

| Risk Mitigation | Protects against job loss or recession | Maintaining a side hustle |

| Wealth Building | Allows reinvestment into assets | Investing in stocks or real estate |

| Lifestyle Flexibility | Enables pursuing passions | Turning hobbies into side income |

Takeaway: A diversified income approach is essential for achieving financial independence and long-term wealth.

Passive vs. Active Income: Understanding the Difference

Understanding the difference between passive and active income is crucial for wealth building.

Active income requires direct effort, such as working a 9-to-5 job or freelancing. You exchange time for money, which can be limiting in terms of earning potential.

Passive income, on the other hand, generates money with minimal ongoing effort.

Examples of passive income include rental income, dividends from stocks, or earnings from digital products. While active income provides immediate cash flow, passive income allows you to earn money even while you sleep.

Building passive income takes time and initial investment, but it offers long-term financial freedom.

A balanced combination of both types of income can help you achieve greater financial security.

Focus on growing passive income to increase wealth without constant effort.

When creating multiple income streams, it’s essential to distinguish between active and passive income.

Active income requires your time and energy, such as a part-time job or freelance work, while passive income allows you to earn money with minimal ongoing effort, like rental income or dividends.

Key Points:

- Active Income: Includes side jobs, freelance projects, consulting, or tutoring. These activities require time and effort.

- Passive Income: Examples include dividends from investments, rental properties, and royalties from intellectual property.

Takeaway: A balanced mix of both passive and active income can enhance financial security and long-term wealth-building.

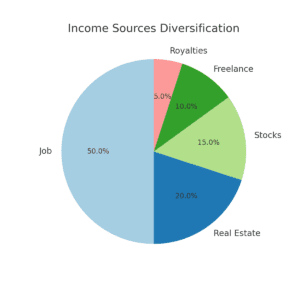

Pie Chart: Income Sources Diversification

The pie chart below illustrates the distribution of income across various sources in a diversified portfolio:

- Job (50%): This represents the largest portion, where the majority of income comes from traditional employment.

- Real Estate (20%): Income generated from rental properties or real estate investments, contributing to financial stability.

- Stocks (15%): Earnings from dividends and capital gains on stock investments.

- Freelance (10%): Side income earned from freelance work, providing flexibility and additional cash flow.

- Royalties (5%): Passive income earned from intellectual property such as books, music, or patents.

This diversified approach spreads risk while maximizing earning potential. The balance between active and passive income sources is key for long-term financial success.

Pie Chart:

Takeaway: A balanced mix of both passive and active income can enhance financial security and long-term wealth-building.

Investment Income: Building Wealth Through Investments

Investment income is a powerful way to build wealth and achieve financial freedom.

By investing in assets like stocks, bonds, and real estate, you can earn returns on your capital.

Dividends from stocks and interest from bonds provide a steady flow of passive income.

Real estate investments, such as rental properties, offer both income and potential appreciation in value.

Mutual funds and ETFs allow diversification, spreading risk across various investments.

Reinvesting your investment income accelerates wealth growth. Understanding the risks associated with each investment is crucial for making informed decisions.

Long-term investments tend to provide higher returns, allowing wealth to compound over time.

The key to success is consistency and a disciplined approach. Building wealth through investments requires patience, but it offers significant financial rewards in the long run.

Investments are a crucial part of any income diversification strategy. Investment income can come from a variety of sources, such as stocks, bonds, mutual funds, and real estate.

This income stream allows your money to work for you, building wealth with time.

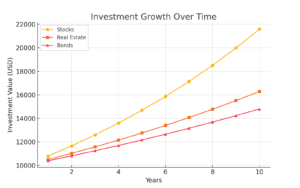

Line Chart: Investment Growth Over Time

This chart demonstrates the growth of investments over a decade:

- Stocks: 8% annual growth

- Real Estate: 5% annual growth

- Bonds: 4% annual growth

Line Chart:

Takeaway: With proper planning, investment income can provide financial security and significant wealth accumulation.

Real Estate: A Time-Tested Income Source

Real estate has long been a time-tested source of income and wealth building. Rental properties provide a consistent stream of passive income through monthly rent payments.

Real estate appreciates over time, allowing investors to benefit from property value growth.

The ability to leverage financing to purchase properties makes real estate a powerful tool for building wealth.

Real estate investments also offer tax advantages, such as deductions for mortgage interest and property taxes.

Commercial properties and vacation rentals can generate higher returns than residential properties.

A well-diversified real estate portfolio can reduce risk and enhance long-term financial stability. Understanding the market and location is key to making profitable real estate investments.

With careful planning and management, real estate can become a reliable and lucrative income source.

Real estate is a powerful way to generate multiple income streams. By investing in rental properties, REITs (Real Estate Investment Trusts), or vacation rentals, you can enjoy both passive income and potential property appreciation.

Key Strategies:

- Rental Properties: Renting out property is a long-term income generator, providing monthly rental income.

- Vacation Rentals: Platforms like Airbnb allow property owners to earn income by renting to travelers.

- REITs: These allow you to invest in real estate without managing physical properties.

Takeaway: Real estate offers reliable income opportunities and serves as a valuable asset for long-term wealth building.

Building an Online Business for Additional Income

Building an online business is a great way to generate additional income with minimal overhead costs.

E-commerce platforms like Shopify or Etsy allow you to sell products without the need for a physical store.

Affiliate marketing provides opportunities to earn commissions by promoting products or services you trust. Offering digital products, such as courses or e-books, creates passive income streams.

Freelancing platforms enable you to monetize your skills and work with clients globally. Subscription-based models, such as memberships or SaaS products, offer recurring revenue.

Social media and content marketing can drive traffic to your online business, increasing sales. Automating parts of your business can save time and improve efficiency.

The scalability of an online business means the potential for significant income growth. Consistency, quality, and customer service are key to long-term success.

The rise of the digital economy has opened up numerous avenues for generating income online.

An online business can provide both passive and active income, depending on the model you choose.

Options include e-commerce stores, digital products, blogging, and affiliate marketing.

Bar Chart: Monthly Income Growth from an Online Store

The chart below illustrates a year’s growth for an online store, starting at $200 in January and reaching $2,000 by December.

Bar Chart:

Takeaway: Online businesses offer scalable income opportunities and can be managed remotely, providing flexibility and potential passive income.

Conclusion

Achieving financial freedom through multiple streams of income is not only a strategic choice but also a necessity in today’s dynamic economic landscape.

Relying solely on a single source of income exposes you to unnecessary risks, such as job loss, market downturns, or unforeseen personal expenses.

The road to financial freedom requires effort, persistence, and smart decision-making.

Start small, focus on one or two income streams, and gradually build your portfolio.

Remember, diversification is key, and having a mix of active and passive income ensures stability and growth.

By taking consistent steps today, you can create a future where financial security and freedom are within reach.

With determination and the right strategy, you can transform your financial outlook and live the life you’ve always envisioned.

Hasnain Aslam is a seasoned finance blogger and digital marketing strategist with a strong expertise in SEO, content marketing, and business growth strategies. With years of experience helping entrepreneurs and businesses boost their online presence and maximize organic traffic, he specializes in crafting high-impact content that ranks on search engines and drives real results. His insights empower professionals to build sustainable digital success through strategic marketing and innovative SEO techniques.

Pingback: Master the 4 Pillars of Personal Finance for Freedom